Amazon returns are an unavoidable part of selling on the marketplace. For most sellers, returns are viewed as a simple transaction: a customer sends an item back, Amazon issues a refund, and the order is closed. The financial impact is often calculated as the refunded revenue plus a few visible fees.

But this narrow view hides the real problem.

Amazon returns create a chain reaction of costs that affect inventory health, advertising efficiency, operational time, and long-term profitability. Many sellers only realize how damaging returns are after margins shrink—or when performance metrics quietly decline.

This article breaks down the hidden costs of Amazon returns, why they are easy to overlook, and what sellers should track to understand their true impact.

At a surface level, Amazon returns feel straightforward. A product is returned, and revenue from that order is reversed. Because Amazon handles the logistics, many sellers assume the damage ends there.

In reality, returns don’t exist in isolation.

Each return interacts with multiple parts of a seller’s business: fulfillment fees, inventory status, advertising spend, storage, and even customer perception. The problem is not that sellers ignore returns—it’s that Amazon’s systems make it difficult to see their full financial footprint in one place.

As a result, Amazon returns quietly erode profit without triggering obvious alarms.

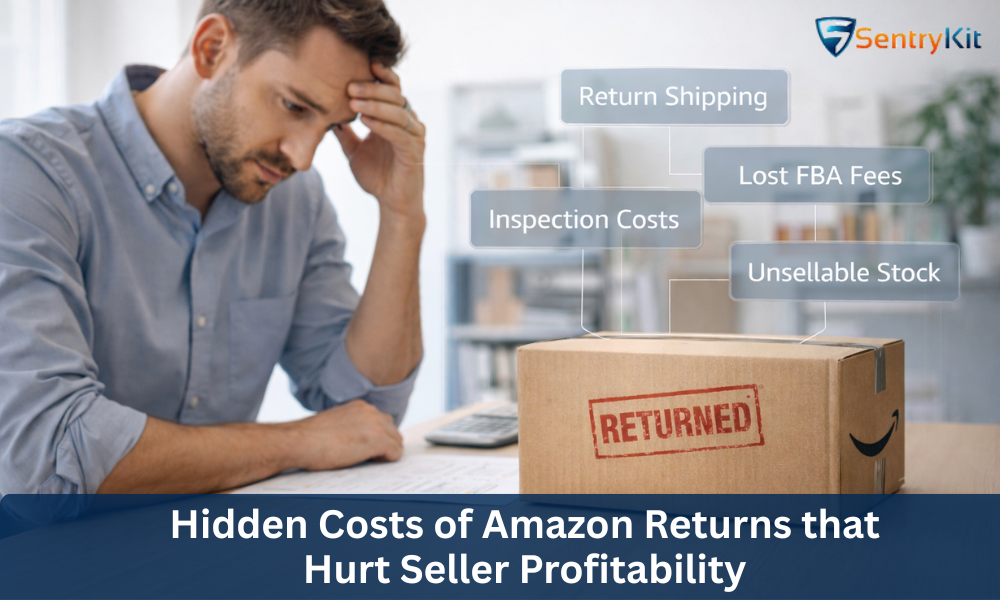

Most sellers are aware of the immediate, visible costs associated with Amazon returns. These include refunded order value, return shipping, and fba fulfillment fees for FBA products.

While these costs are painful, they are predictable and relatively easy to spot in Seller Central reports. Sellers often stop their analysis here, believing they understand the downside of returns.

This is where the mistake begins.

The direct costs are only the entry point. The larger losses come from what happens after the return is processed.

One of the most underestimated aspects of Amazon returns is their impact on inventory.

Returned items don’t always re-enter sellable stock. Products may be marked as damaged, unsellable, or stuck in “reserved” status for extended periods. Even when items are technically sellable, delays in inspection and restocking can leave inventory unavailable during critical selling windows.

Over time, this creates several problems:

Increased stranded and aging inventory

Higher storage and removal fees

Capital locked in unsellable stock

Disrupted replenishment planning

For sellers operating at scale, these issues compound quickly. Inventory that should be driving sales instead becomes dead weight—especially when return rates fluctuate unpredictably.

Another hidden cost of Amazon returns appears in advertising performance.

When a customer clicks an ad, makes a purchase, and later returns the product, the ad spend is not refunded. From an advertising perspective, that sale becomes a loss rather than a conversion.

High return rates can also suppress listing performance. Lower conversion rates signal weaker buyer satisfaction, which can affect ad efficiency, keyword rankings, and Buy Box competitiveness. Over time, sellers may spend more on ads just to maintain the same level of visibility—further shrinking margins.

This is one of the reasons why sellers sometimes feel their advertising “stopped working,” when the real issue is rising Amazon returns quietly undermining performance.

Beyond normal returns, return abuse and fraud are becoming increasingly common on Amazon.

Examples include customers returning used or damaged items as “new,” ordering products for short-term use, or repeatedly exploiting return policies. While Amazon prioritizes customer experience, this often leaves sellers absorbing the cost.

What makes return abuse particularly damaging is its subtlety. Individual cases may seem insignificant, but patterns emerge over time—especially for higher-priced or easily resold products.

Because abuse-related losses are scattered across refunds, inventory write-offs, and operational overhead, many sellers don’t connect them directly to Amazon returns until profits noticeably decline.

One of the biggest reasons sellers underestimate Amazon returns is reporting fragmentation.

Refund data, inventory status, fulfillment fees, advertising costs, and storage charges all live in different reports. Seller Central doesn’t provide a single view that ties a returned order to its full downstream impact.

As a result, sellers often analyze returns in isolation rather than as part of a broader profitability equation. Without connecting these data points, it’s easy to assume returns are “under control” when they are quietly creating margin pressure.

This is why many sellers rely on additional monitoring and alerts to flag unusual spikes in returns, inventory status changes, or Buy Box disruptions before they escalate.

To fully understand the impact of Amazon returns, sellers need to move beyond refund counts and return rates.

Key areas to monitor include return rates by ASIN, unsellable inventory percentages, time-to-restock delays, and profit after returns—not just gross revenue. Tracking how returns correlate with ad spend and conversion performance can also reveal patterns that standard reports miss.

The goal isn’t to eliminate returns entirely—that’s unrealistic on Amazon—but to identify where returns are disproportionately affecting profitability and operational efficiency.

Reducing the cost of Amazon returns doesn’t mean discouraging buyers or restricting policies. Instead, it requires operational awareness.

Clear listings that accurately set expectations, consistent product quality, and proactive monitoring of return trends all play a role. Sellers who identify unusual return spikes early can often address issues—whether it’s a listing mismatch, packaging problem, or emerging abuse pattern—before losses accumulate.

The most effective sellers treat returns as a performance signal, not just a customer service outcome.

Amazon returns are not simply a cost of doing business—they are a profitability variable that deserves ongoing attention.

When sellers focus only on refunded revenue, they miss the broader impact returns have on inventory health, advertising efficiency, and long-term margins. The real cost of Amazon returns lies in their ability to quietly drain profit across multiple areas of a business.

Sellers who understand this—and who track returns holistically rather than in isolation—are far better positioned to protect margins and make informed operational decisions as competition on Amazon continues to intensify.